Author: Steve Schwen

iVEAcare Launches with $27.5 Million in Series A Funding from Leading Medtech Investors

Elucent Medical Secures Series C Funding to Advance Oncologic Surgery Innovation

Vensana Capital Strengthens Team with Promotions and Addition of Venture Partner

January 3, 2024

MINNEAPOLIS & WASHINGTON, DC—(BUSINESS WIRE)—Vensana Capital, a leading medical technology-focused venture capital and growth equity investment firm, today announced the promotions of Amrinder Singh, Cynthia Yee, Greg Banker, and Mike Kramer to Partner and Steve Schwen to Partner & Chief Financial Officer. The firm also announced the addition of veteran medtech leader Bill Hoffman as a Venture Partner.

“Since launching Vensana in 2019, we have set out to build the deepest, most experienced team in our sector. Our promoted team members bring diverse backgrounds and expertise, and each has emerged as a leader within the firm and in the community. We are excited to support them as they take this important step forward in their careers,” said Vensana Managing Partners Kirk Nielsen and Justin Klein. “In addition, we are proud to welcome Bill to our growing team. He brings an impressive track record as an entrepreneur and executive, and we look forward to working with him to build the next generation of category-defining medtech companies.”

Amrinder Singh promoted to Partner (Minneapolis)

Amrinder joined Vensana in 2021 after nearly a decade at Medtronic, where he was most recently a Senior Investment Director at Medtronic Ventures leading and supporting new investments across the medtech sector. Prior to his investment role, Amrin led business development and strategy for Medtronic’s remote monitoring and services businesses, and he was previously with the corporate strategy group. Earlier in his career, Amrin held product management and engineering positions at Thoratec. Amrin currently serves on the board of Nyra Medical.

Cynthia Yee promoted to Partner (SF Bay Area)

Cynthia joined Vensana in 2019 and brings nearly two decades of investing, operating, and public equities experience and a unique perspective on the full cycle of healthcare innovation and commercialization. Prior to Vensana, she served as a Principal at Windham Venture Partners, where she led the firm’s investments in numerous companies that have successfully exited, including Cartiva Medical, ClarVista Medical, and Personal Genome Diagnostics. She was previously an investor at NEA working across its medtech and healthcare services practices, and she spent time in business development and strategic marketing at Epix Therapeutics and medtech incubator D3DC. Cynthia began her career in public equities, covering medical devices at Piper Jaffray and biotechnology at Pacific Growth Equities. Cynthia currently serves on the boards of Evident Vascular and SpyGlass Pharma.

Greg Banker promoted to Partner (Minneapolis)

Greg joined Vensana in 2019 and has over a decade of investing, operating, and consulting experience. Prior to joining Vensana, he served as Director of Strategic Market Development at Vertiflex, an interventional spine company that was acquired by Boston Scientific. Before Vertiflex, Greg worked as an Associate Director at Navigant Consulting, where he advised medtech CEOs and boards of directors on over two dozen strategic market assessments across a range of areas including cardiology, interventional pain, orthopedics, neurology, and robotic surgery. Greg currently serves on the board of Artelon.

Mike Kramer promoted to Partner (SF Bay Area)

Mike Kramer joined Vensana in 2021, bringing to the firm over 20 years of finance and operations experience. Prior to Vensana, Mike was an Operating Partner at CRG, a leading provider of structured debt and equity capital for growth-stage healthcare companies, where he advised on multiple medtech investments and worked directly with the boards of CRG’s portfolio companies. Previously, Mike served as CFO or COO at private and public medtech companies, including Endologix, TriVascular (IPO, acquired), and ATS Medical (acquired).

Steve Schwen promoted to Partner & Chief Financial Officer (Minneapolis)

Steve Schwen joined Vensana in 2019, and he leads all non-investment functions at the firm. Steve brings over 25 years of finance and operations management experience within venture capital firms, with much of that experience coming from his time as CFO at Split Rock Partners and St. Paul Venture Capital. Steve began his career at KPMG, where he provided audit and consulting services to financial services companies.

Bill Hoffman joins as Venture Partner (Orange County)

Bill Hoffman joins Vensana Capital as a Venture Partner. Bill currently serves on the board of Inari Medical, where he held the CEO role from 2015 until late 2022. He led the company’s transformation from a private single-product clinical-stage company to a public company with a diversified product portfolio and nearly $400 million in revenue that established a new standard-of-care for venous thromboembolism patients globally. Bill previously served as CEO at Visualase, which developed and commercialized a laser ablation treatment for brain disorders that was acquired by Medtronic in 2014. Earlier in his career, Bill served as Vice President of Sales at FoxHollow Technologies, which pioneered atherectomy therapy prior to its acquisition by ev3 in 2007.

About Vensana Capital

Vensana Capital is a venture capital and growth equity investment firm dedicated to partnering with entrepreneurs who seek to transform healthcare with breakthrough innovations in medical technology. Launched in 2019, Vensana manages $550 million in capital and is actively investing in development and commercial stage companies across the medtech sector, including medical devices, diagnostics and data science, life science tools, digital health, and tech-enabled services. Vensana’s investment team has a history of successfully partnering with management teams behind industry-leading companies including Cameron Health, CardiAQ, Cartiva, CV Ingenuity, CVRx, Epix Therapeutics, Inari Medical, Intact Vascular, Lutonix, Neuwave Medical, Personal Genome Diagnostics, Relievant Medsystems, Sequent Medical, Topera, Ulthera, Veran Medical Technologies, Vertiflex and Vesper Medical. Learn more at www.vensanacap.com.

Boston Scientific Closes Acquisition of Relievant Medsystems, Inc.

Evident Vascular Exits Stealth with $35 Million Series A Funding to Develop Vascular Imaging Platform

Boston Scientific Announces Agreement to Acquire Relievant Medsystems, Inc.

SpyGlass Pharma Completes $90 Million Series C Financing to Advance Novel Treatments for Glaucoma and other Chronic Ophthalmic Diseases

Artelon, Inc. Secures $20M in Funding to Advance Surgical Treatment of Joint Instability

Relievant Medsystems Raises $50 Million to Advance the Treatment for Chronic Vertebrogenic Low Back Pain

Alleviant Medical Closes $75M in Financing; Receives FDA IDE Approval for Pivotal Clinical Trial

Curate Biosciences launches its first product to transform cell therapy manufacturing costs and performance

Volta Medical Secures €36M in Series B Funding to Support Adoption of its AI Software for Cardiac Ablation

Curate Biosciences Announces David Backer as Chief Executive Officer

Nyra Medical Announces $20 Million Series A Financing for its Transcatheter Heart Valve Repair Technology

Relievant Medsystems Announces Updated Policy Statement and Guideline for Basivertebral Nerve Ablation from the International Society for the Advancement of Spine Surgery

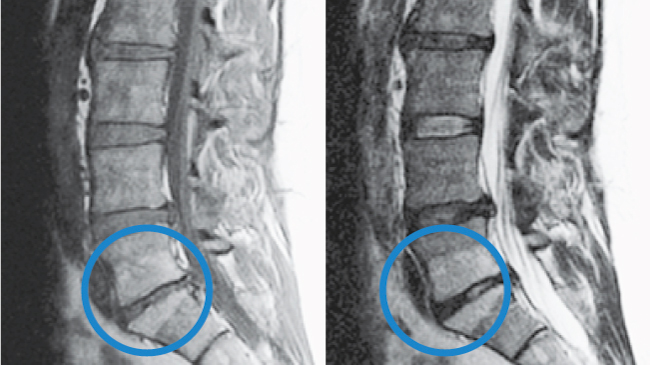

MINNEAPOLIS – November 8, 2022 – Relievant Medsystems, a company dedicated to transforming the diagnosis and treatment of vertebrogenic pain, a type of chronic low back pain (CLBP), today announced that the International Society for the Advancement of Spine Surgery (ISASS) has published an updated Policy Statement and Literature Review of Intraosseous Basivertebral Nerve (BVN) ablation in the October issue of the International Journal of Spine Surgery.

The ISASS policy recommends intraosseous BVN ablation as the most successful way to address vertebrogenic chronic low back pain. This update follows the September publication of Best Practice Guidelines on the Diagnosis and Treatment of Vertebrogenic Low Back Pain with BVN Ablation from the American Society of Pain and Neuroscience (ASPN) and demonstrates additional society support for BVN ablation. Relievant Medsystems’ minimally invasive Intracept® Procedure is the only FDA-cleared treatment for chronic vertebrogenic low back pain.

“We see the positive impact that the Intracept Procedure has on patients, and expanded society support of BVN ablation further underscores the efficacy of this treatment for chronic vertebrogenic low back pain,” said Tyler Binney, President and CEO of Relievant Medsystems. “These updated guidelines, in addition to our substantial base of clinical evidence, will help to continue driving awareness and adoption of this proven therapy.”

The Intracept Procedure uses targeted radiofrequency energy to stop the BVN from transmitting pain signals to the brain. The procedure is typically performed in an outpatient surgery center and takes approximately one hour. Based on existing data, patients typically experience minimal post-procedure pain and generally quick recovery times. Patients often feel pain relief within two weeks of being treated with the Intracept Procedure.

About Vertebrogenic Pain

Of the 30 million people in the U.S. with chronic low back pain, 1 in 6 are likely to have vertebrogenic pain, a distinct type of chronic low back pain caused by damage to vertebral endplates, the interface between the disc and the vertebral body. Patients typically have pain in the middle of their low back, which worsens when they bend over, sit for long periods of time, or when they are active. A physician can confirm a patient’s pain is vertebrogenic by observing Modic changes, a biomarker seen on standard MRI that indicates inflammation at the vertebral endplate.

About Relievant Medsystems

Relievant Medsystems is a commercial-stage medical device company transforming the diagnosis and treatment of vertebrogenic pain, a form of Chronic Low Back Pain (CLBP), with the Intracept Procedure – a novel, clinically proven and commercially available treatment designed to improve the quality of life for millions of indicated patients. For more information about Relievant Medsystems and the Intracept Procedure, visit www.relievant.com.

Heart Health Innovator Cleerly Closes Series C Funding Round with $223 Million

Moxe Health Raises $30M Series B to Further Advance Interoperability

Relievant: Just Clear, Rigorous High-Quality Data

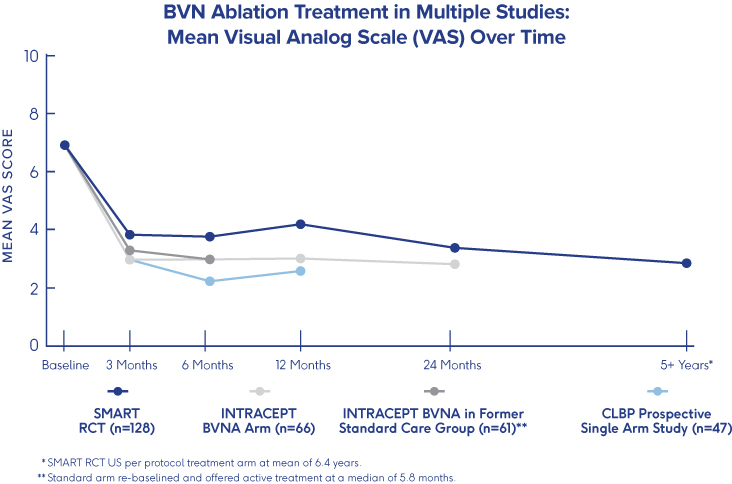

Results from Multiple Clinical Trials Demonstrate the Intracept Procedure is:

Safe

Effective

Durable

Reproducible

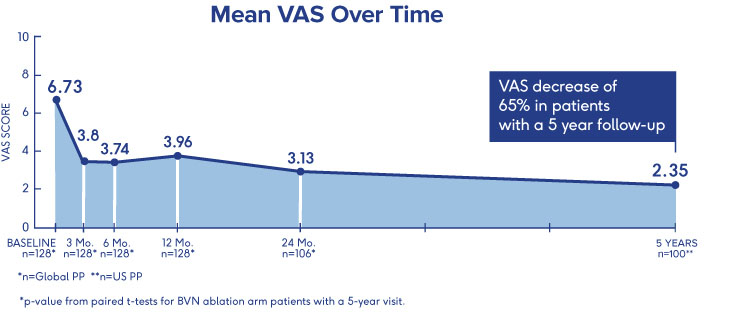

SMART Trial

5-Year Durability2

- VAS: 4.38 reduction at 5 years (from 6.74 to 2.35 (p<0.001))†

- ODI: 25.95 reduction at 5 years (from 42.81 to 16.86 (p<0.001))†

- One-third (34%) of patients were pain free at 5 years†

†p-value from paired t-tests for BVN ablation arm patients with a 5-year visit

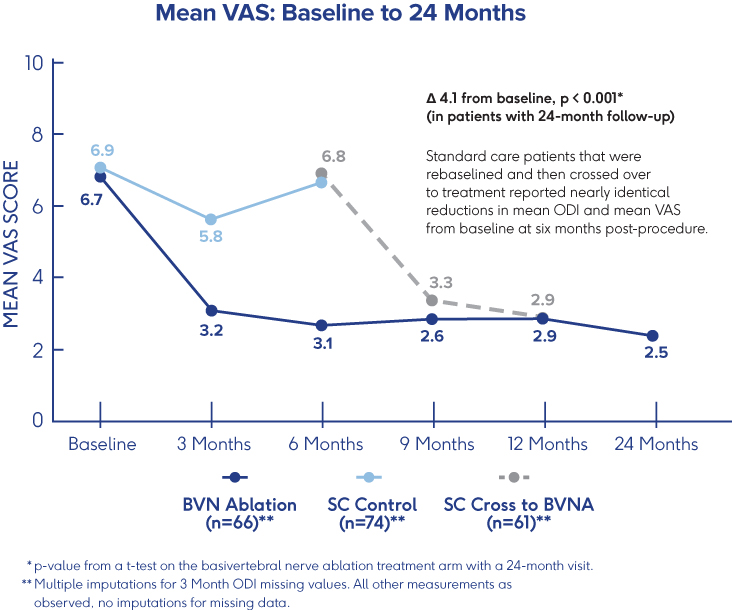

INTRACEPT Study

24-Month Results Demonstrate

Sustained Relief 3

- VAS: 4.1 cm mean reduction from baseline to 24 months post-procedure (p<0.001)†

- ODI: 28.5 point mean reduction from baseline to 24 months (p<0.001)†

- 31% of patients were pain-free 24 months after BVN ablation treatment†

†p-values from paired t-tests of BVN ablation arm patients with a 24-month visit

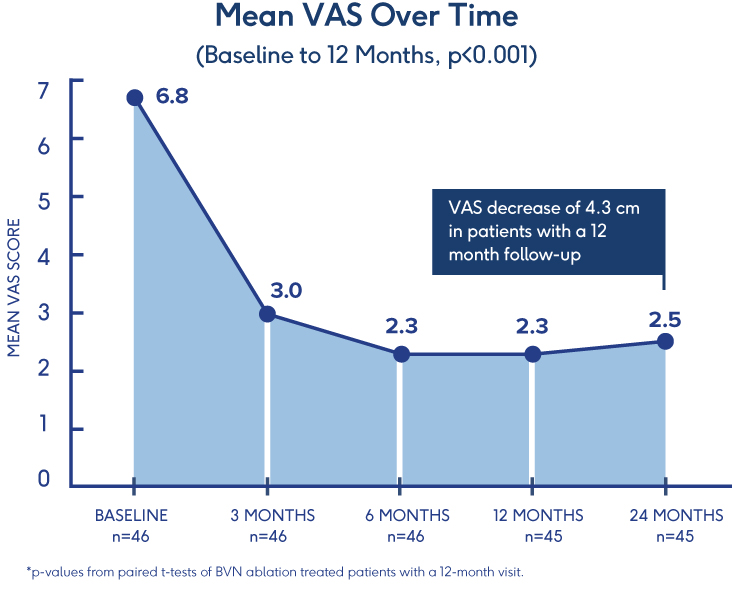

Prospective, Single-Arm Cohort Study

Sustained Relief at 12 Months in

Typical Spine Practices6

- VAS: Mean reduction of 4.3 (p<0.001) from a baseline of 6.82†

- ODI: Mean improvement of 32.31 (p<0.001) from a baseline of 46.98†

- 69% of patients reported >50% reduction in pain while 38% reported being pain-free†

†p-values from paired t-tests of BVN ablation treated patients with a 12-month visit

Pilot Clinical Study

Efficacy of BVN Ablation

in a Clinical Setting 7

- Ablation of the BVN for the treatment of chronic lumbar back pain significantly improved patients’ self-reported outcome early in the follow-up period

- Improvements in function persisted throughout the 1-year study period

- ODI: Statistically significant mean baseline reduction from 52±13 to 23±21 at 3 months follow-up (p<.001); maintained through 12-month follow-up

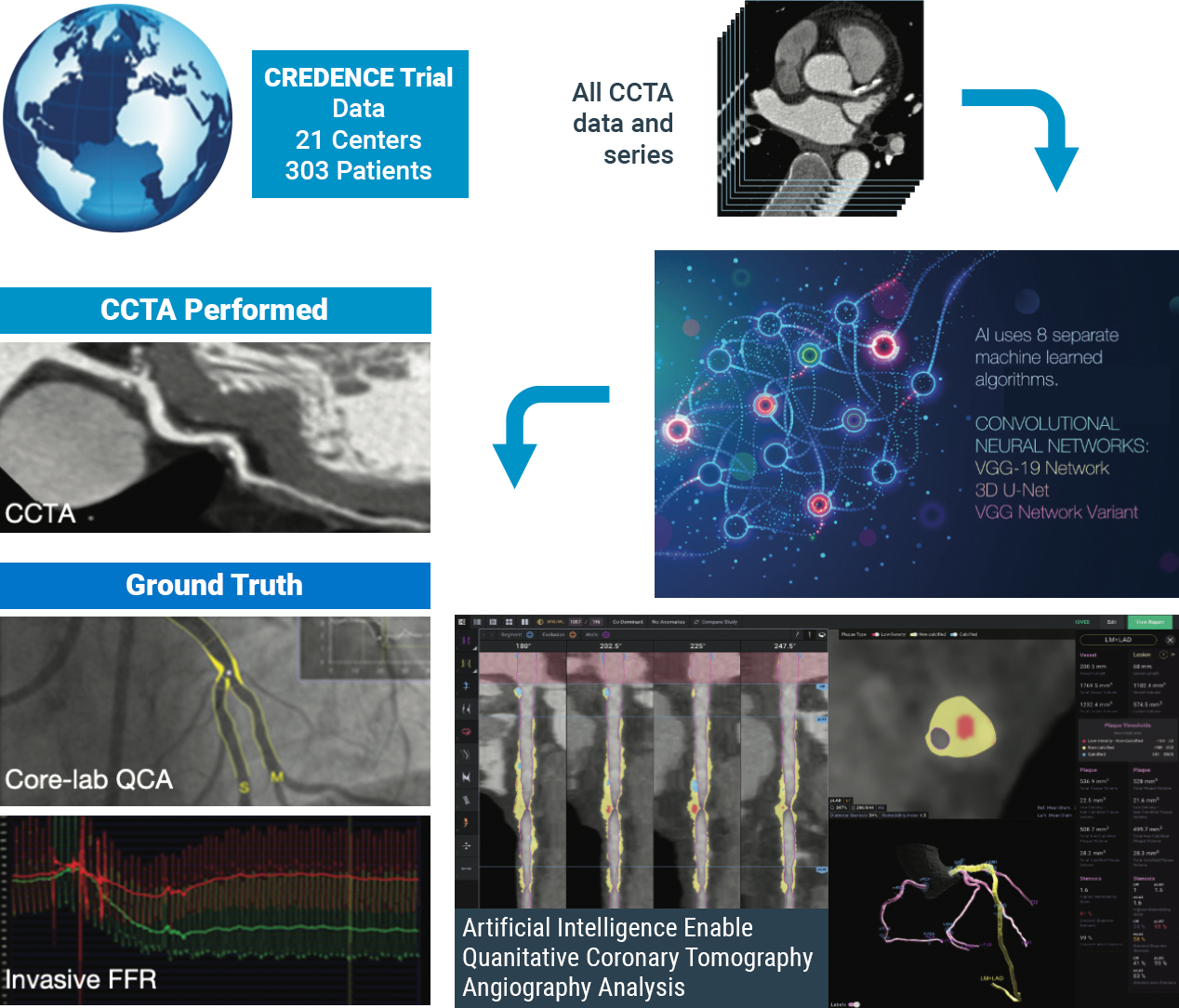

CLARIFY 2 Affirms Cleerly Over Invasive Heart Disease Evaluation Methods

February 14, 2022

Findings from Cleerly’s groundbreaking echo the recent American College of Cardiology guidelines on the use of CCTA for non-invasive heart disease evaluation.

Instead of proactively identifying patients at risk of heart disease, our industry has historically treated patients once symptoms appear, which can result in late or missed diagnoses, as well as unnecessary referrals to catheterization laboratories.

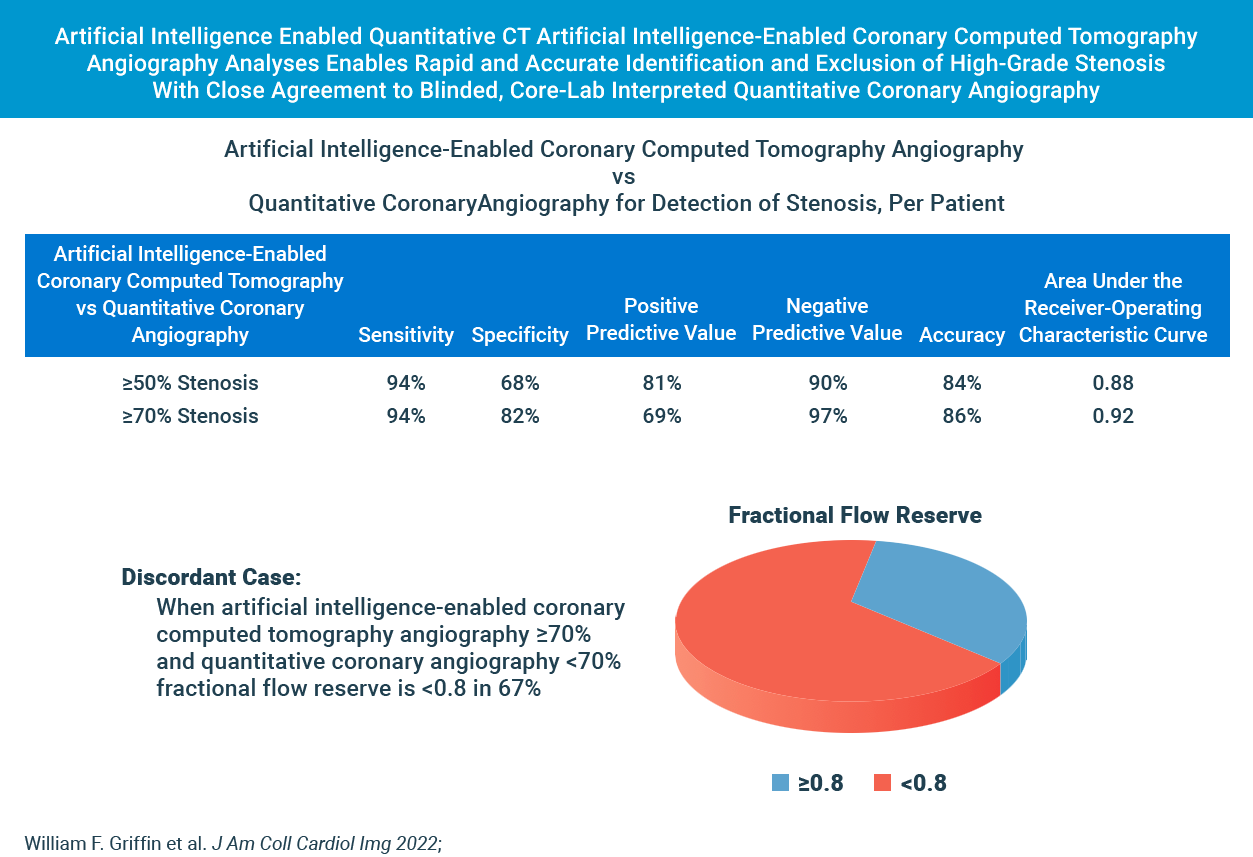

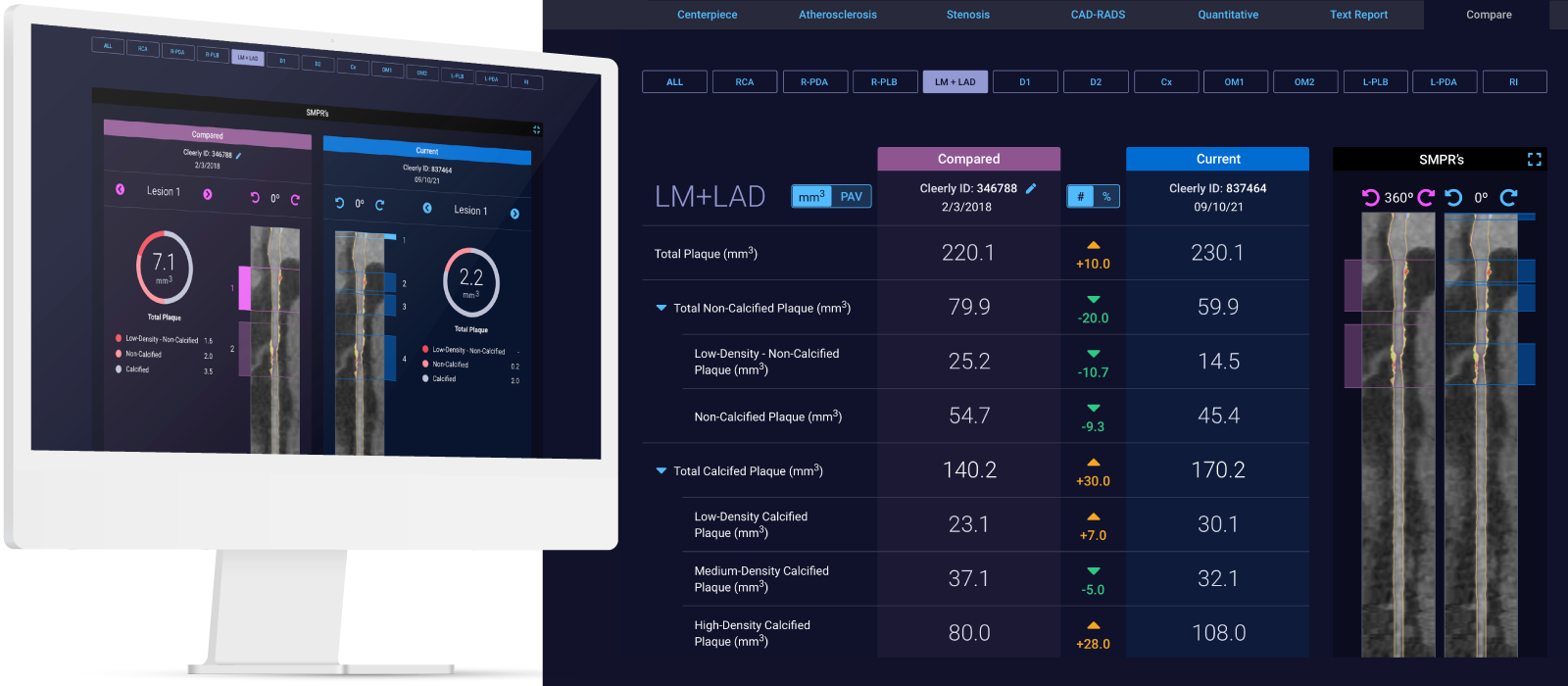

The CLARIFY 2 study, the second of six studies comparing Cleerly analysis against current gold standards to plaque and coronary artery imaging, demonstrates Cleerly’s effectiveness in the identification and exclusion of high-grade stenosis against traditional core-lab interpreted quantitative coronary angiography (QCA) and invasive fractional flow reserve (FFR) methods. The findings in this study echo the recent American College of Cardiology guidelines on the use of CCTA for non-invasive heart disease evaluation.

AI-Based Evaluation of Coronary Artery Stenosis on Coronary CTA Demonstrated High Accuracy to Core Lab-Interpreted QCA and Invasive FFR

Study highlights include:

Cleerly’s identification and characterization of stenosis is highly accurate (>90% sensitive and highly specific)

Study findings show high diagnostic performance of Cleerly’s non-invasive AI-based evaluation for moderate and severe stenosis at both the ≥50% and ≥70% occlusion levels, along with high correlation to invasive QCA. Importantly, the diagnostic performance of Cleerly’s analysis is similar to results in prior multicenter clinical trials being referred for ACC guideline-indicated invasive coronary angiography.

cleerly’s diagnostic performance for moderate and severe stenosis is strong

Cleerly’s AI-based evaluation level of precision is strong based on the area under the receiver-operator characteristic curve (AUC), used to evaluate the diagnostic performance as well as to evaluate the prediction of FFR for both QCA and AI-based CCTA.

The higher the AUC results, the better the model is at distinguishing between patients with disease and no disease. The per-patient AUC is 0.88 for ≥50% moderate stenosis and 0.92 for ≥70% severe stenosis threshold, and a per-vessel AUC of 0.90 for ≥50% moderate stenosis and of 0.95 for ≥70% severe stenosis.

While these scores are numerically higher than those observed by expert core lab readers (AUC: 0.69) and site readers (AUC: 0.57) in the multicenter randomized PROMISE trial, AI-based evaluation for moderate and severe stenosis is significant.

These combined data points offer compelling evidence that clinical use of Cleerly’s AI-based CCTA evaluation serves as an important and useful standard of care for coronary CT interpretation.

| Method | Stenosis | Basis | Sensitivity (95% CI) (%) |

Specificity (95% CI) (%) |

PPV (95% CI) (%) |

NPV (95% CI) (%) |

Accuracy (95% CI) (%) |

AUC (95% CI) (%) |

|---|---|---|---|---|---|---|---|---|

| AI-QCT | ≥50% | Per territory (n = 909) Per patient (n = 303) |

91 (87.1-94.2) 94 (89.8-97.0) |

84 (79.6-86.1) 68 (59.7-75.8) |

69 (64.1-74.4) 81 (74.7-85.5) |

96 (93.8-97.3) 90 (87.2-94.4) |

86 (83.2-88.1) 84 (78.8-87.3) |

0.90 (0.881-0.926) 0.88 (0.843-0.923) |

| QCA | ≥70% | Per territory (n = 909) Per patient (n = 303) |

90 (83.3-94.4) 94 (87.3-97.9) |

91 (88.0-92.8) 82 (76.4-86.8) |

58 (51.0-66.3) 69 (60.5-76.6) |

99 (97.3-99.2) 97 (93.5-99.0) |

91 (88.5-92.8) 86 (81.4-89.3) |

0.95 (0.940-0.966) 0.92 (0.893-0.950) |

| Subgroups based on detection of ≥50% stenosis. AI-QCT = artificial intelligence-enabled computed tomography angiography; AUC = area under the receiver-operating characteristic curve; NPV = negative predictive value; PPV = positive predictive value; QCA = quantitative coronary angiography. |

||||||||

In Cases Where Cleerly and Invasive Angiography Results Disagree, FFR Agrees With Cleerly Over Angiography ⅔ of the Time

The study provides evidence that Cleerly analysis may have performed better than the QCA gold standard used. In the 62 vessels that Cleerly’s estimate of stenosis differed significantly from QCA, we used the “ultimate” gold standard of invasive fractional flow reserve (FFR) to adjudicate the difference. In more than ⅔ of these discordant cases, the FFR result agreed with Cleerly’s output and not QCA.

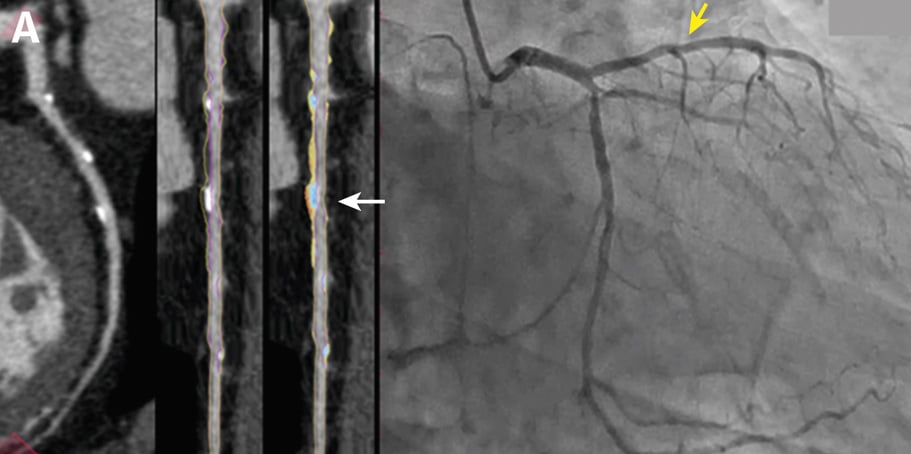

Curved multiplanar reformatted image (MPR) (left), and straightened MPR (second from left) with the lumen boundary (purple line) and outer vessel wall boundary (yellow line) overlay, and with color plaque overlay (second from right) (red is low-density noncalcified plaque [<30 HUs], yellow is noncalcified plaque [31-350 HU], and blue is calcified plaque [>350 HU]). AI depicted a 60% stenosis (white arrow) in the proximal vessel segment. (Right) The left coronary invasive angiogram, in which QCA analysis depicted no stenosis (yellow arrow).

CLARIFY 2 Takeaways

Cleerly’s CLARIFY 2 study aligns with ACC CCTA guidelines and affirms Cleerly’s value over invasive QCA and FFR methods for non-invasive heart disease evaluation. With more than 62% of referrals to catheterization laboratories being unnecessary, cardiac care needs to shift away from treating symptoms and referring patients to the catheterization lab for unnecessary procedures, and focus on preventing heart disease in the first place.

Stay tuned for upcoming results from subsequent CLARIFY studies on the comparison of Cleerly outputs against other gold standards for plaque and coronary artery disease evaluation.

At Cleerly, we focus on identifying patients at risk sooner, quantifying and characterizing disease, enabling personalized and preventive treatment, and improving clinical outcomes that yield significant cost savings for patients and providers.

Envisioning a World Without Heart Attacks: A Call For A New Paradigm of Precision Heart Care

James K. Min, MD, FACC, FESC, MSCCT, Founder & CEO of Cleerly: January 28, 2022

Historically, our diagnostic approaches to patients with suspected heart disease have been restricted to the evaluation of patients with symptoms like chest pain and shortness of breath. Yet, these diagnostic methods fail for the >50% of individuals who will suffer a heart attack without any prior symptoms. This traditional approach misses the majority of heart attack victims for whom heart disease is a “silent killer” that can be prevented through early detection, simple lifestyle changes, and low-cost medical therapy.

Heart disease remains the #1 public health epidemic in the world, causing 1 death every 1.7 seconds. As the leading cause of death and morbidity, heart disease causes more deaths each year than all cancers combined.

Cleerly is a digital healthcare company that is transforming the evaluation of heart disease through precision heart care that measures actual heart disease—atherosclerosis (plaque) that builds up in the walls of the heart arteries—over indirect markers of heart disease, as has been the historical approach. We apply advanced artificial intelligence (AI) technology to non-invasive computed tomography (CT) scans to provide physicians and patients with a heart attack prevention approach that is more personalized and proactive.

Our solutions offer accurate, precise, simple, and rapid heart disease evaluation, with the information delivered to each and every stakeholder in the heart attack prevention care pathway – be they radiologists, primary care physicians, cardiologists, or patients and their caregivers. Through innovative reporting techniques, physicians can now knowingly provide personalized treatment plans and determine whether these treatments are actually halting the progression of heart disease, dramatically improving clinical outcomes, and drastically reducing the costs associated with late-stage cardiovascular care.

Cleerly offers a new and differentiated digital care pathway to prevent heart attacks by delivering the most useful information to physicians and patients in a manner that is simple, stepwise, and logical.

These steps include:

identify and measure actual heart disease, not indirect markers of disease

Historical approaches to evaluating heart disease have relied upon measuring risk factors, such as cholesterol levels in individuals without symptoms; and stress testing in individuals with symptoms to determine whether blood flow is reduced to the heart muscle, a condition known as ischemia. For individuals with symptoms, patients with abnormal stress tests are often referred for invasive coronary angiograms to determine whether a narrowing of the heart artery (referred to as a stenosis) is the cause of ischemia. When considering this diagnostic approach, indirect markers such as risk factors, ischemia and stenosis do not actually measure heart disease, which is the atherosclerosis (plaque) itself.

Through research performed over the last 15 years, the field of cardiology has discovered that there is not one but rather many different types of heart disease. Some types of atherosclerosis (plaque) are very dangerous and represent the strongest predictor of which patients will suffer future heart attacks. In contrast, some types of atherosclerosis (plaque) are very stable and, in some cases, can protect against heart attacks. Cleerly’s AI-enabled analyses allow for whole-heart assessment of all of the arteries and their branches for quantification and characterization of the different types of atherosclerosis (plaque) that affect a patient; this allows for a precise understanding of a patient’s heart condition.

Leveraging whole-heart analysis can improve diagnosis and support physicians in their determination of an individual’s risk of heart attack based on atherosclerosis and integration of other contributors of heart disease including genetic, clinical, social, and environmental factors.

translate advanced imaging insights for all healthcare professionals

At Cleerly, we study advanced imaging findings related to heart disease in order to better understand the different types of heart disease, and how treatment with medications and lifestyle affect atherosclerosis (plaque) over time. The improved evaluation of heart disease from advanced imaging is a large step forward towards better understanding heart disease and heart attack prevention.

We recognize that most healthcare professionals are not familiar with advanced non-invasive imaging and may not be aware of the latest research findings. To address this, Cleerly’s digital care pathway translates advanced imaging into actionable clinical insights that can be readily understood and acted upon in real-time by all healthcare professionals, including primary care physicians, nurse practitioners, physicians assistants, general cardiologists, interventional cardiologists, radiologists and many others.

empower patients with knowledge to improve health literacy

After taking care of heart disease patients for two decades, we have observed that patients are much more proactive and involved with improving their health when they actually understand their disease conditions. In this regard, traditional medical reports that we give to patients offer very little guidance in helping them better understand their condition. These reports are too often specialized and require a medical degree to understand.

At Cleerly, we believe that preventing heart attacks requires a team, and the most important member of the team is the patient. While Cleerly’s precision diagnostics are powered by advanced machine learning to deliver precise results on the type and amount of disease present, the results of the Cleerly analysis are provided to patients using web-based interactive tools, personalized reports, and educational resources that help patients make informed decisions about their health.

treat and track disease

Evidence-based, precision medicine for cardiology care is critical for treating actual disease over indirect markers of disease. In this regard, Cleerly has partnered with the American College of Cardiology to emphasize heart disease – atherosclerosis (plaque) – as a primary therapeutic target to encourage physicians to leverage medications and lifestyle interventions that have been proven to reduce the risk of a heart attack.

While our therapeutic “toolbox” for heart attack prevention is heavy—with more than 20 different medications and countless lifestyle changes that are effective at reducing heart attacks—these medications may have different relative benefits in different individuals. In prior studies, the rate of progression of heart disease varies among individuals with rapid progressors of heart disease and those not responding well to medical therapy experiencing the worst prognosis. Cleerly’s technology allows not only for a single evaluation of heart disease, but enables physician tracking of therapeutic success over time to prove that the treatments have halted disease progression and stabilized the atherosclerosis (plaque).

a new paradigm for heart attack prevention

Cleerly’s AI-enabled digital care pathway advances a new paradigm of care that empowers physicians and patients to (1) improve diagnosis, sooner and with greater accuracy and precision; (2) enhance understanding for all stakeholders in the care pathway; (3) guide personalized treatment, whether lifestyle or medical therapy; and (4) track therapeutic success by assessing disease progression and plaque transformation. In doing so, Cleerly’s digital care pathway supports heart attack prevention as the primary goal over more historical approaches where symptom relief is the end goal. We believe that all patients with significant heart disease should be identified early to optimize treatment and prevention. Our AI-enabled digital care pathways model with the translation of advanced imaging science into actionable clinical insights is the first of its kind for evaluating heart disease risk and developing personalized treatment and prevention plans.

While providers have leveraged advanced imaging to encourage personalized medicine to prevent the most common causes of cancer, personalized medicine has not been available for heart attack prevention. Cleerly is making this a reality.

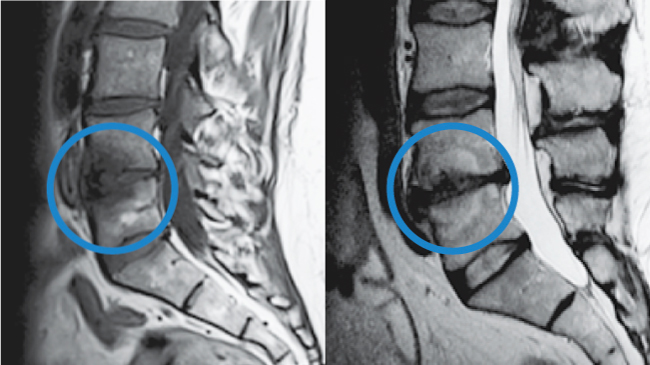

Relievant: When there’s a clear, documented way to diagnose vertebrogenic pain. That’s Living Proof.

The Background

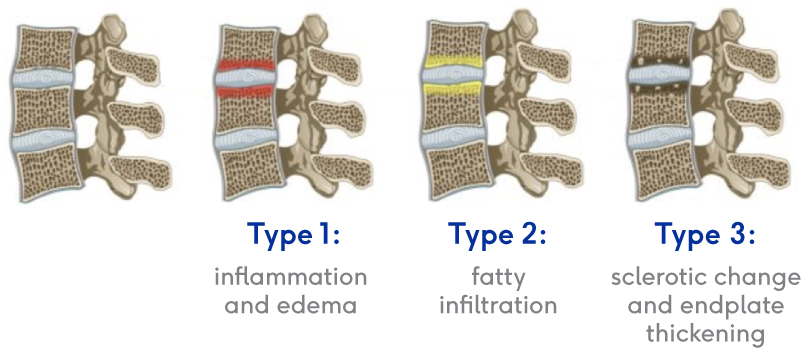

To confirm that a patient has vertebrogenic pain, physicians use MRI to look for specific changes that occur with endplate inflammation, which are called Modic changes.

They’re called “Modic changes” because in 1988, Dr. Michael Modic was the first to publish on identifying and classifying degenerative endplate and marrow changes surrounding a dehydrated intervertebral disc. There were three types of bone marrow changes identified: Types 1, 2 and 3. Types 1 and 2 are the ones that can be used to identify vertebrogenic pain.

Modic Type 1

- Vascular development in the vertebral body

- Findings of inflammation and edema

- NO trabecular damage or marrow changes

Modic Type 2

- Changes in bone marrow

- Fatty replacement of formally red cellular marrow

- Marrow is substituted with visceral fat

- Same fat located on hips and bellies

Labcorp Strengthens Oncology Leadership Position With the Addition of Personal Genome Diagnostics

Apella Announces $21 Million Series A Funding to Digitize the Operating Room

Philips to further expand its image-guided therapy devices portfolio through acquisition of Vesper Medical

Vensana Capital Raises $325 Million and Expands Team to Back Transformative Medical Technology Innovations

September 27, 2021

MINNEAPOLIS & WASHINGTON, DC—(BUSINESS WIRE)—Vensana Capital today announced the closing of its second fund, Vensana Capital II, with $325 million in committed capital. The fund was oversubscribed at its hard cap with the support of the firm’s investors in its inaugural fund alongside select new institutional investors.

Vensana Capital launched in 2019 as a venture capital and growth equity investment firm dedicated to partnering with innovative medical technology companies in their development and commercial stages. Medtech sub-sectors of interest to the firm include medical devices, diagnostics and data science, life science tools, digital health, and tech-enabled services. In the time since inception, Vensana has been recognized as one of the most active investors in its areas of interest with a diversified portfolio of companies advancing best-in-class and first-in-class products. The firm has made 10 investments to date, including Intact Vascular, which was acquired last year by Philips, and CVRx, which recently completed its IPO.

Vensana co-founders Justin Klein, M.D., J.D. and Kirk Nielsen are joined by a team of experienced investment professionals including Principal Cynthia Yee and Vice President Greg Banker, plus recent additions Venture Partner Mike Kramer and Principal Amrinder Singh, in addition to Chief Financial Officer Steve Schwen. Mike joined the firm earlier this year from healthcare investment firm CRG after multiple senior operating roles in public and private medtech companies, and Amrinder recently joined from Medtronic Ventures after a variety of roles at Medtronic and Thoratec. Both bring complementary expertise in healthcare investing, operations, and strategy. Vensana’s investment team is further strengthened by an advisory board comprised of more than two dozen senior medtech executives, entrepreneurs, and subject matter experts.

“We are proud of the progress that Vensana has made since launch – especially our growing investment team and our portfolio of companies tackling important unmet needs – and we are grateful for the continued strong support of our limited partners,” said Managing Partner Kirk Nielsen. “Our entire team is excited about the opportunity in front of us as we work hard to build a leading medtech investment and company building platform.”

“Medical technology innovations have the ability to dramatically improve healthcare quality and outcomes while simultaneously reducing costs. We believe Vensana has both a tremendous opportunity and a responsibility to support our entrepreneurs in their pursuit of technologies and businesses that will transform healthcare for the future,” said Managing Partner Justin Klein, M.D., J.D.

About Vensana Capital

Vensana Capital is a venture capital and growth equity investment firm dedicated to partnering with entrepreneurs who seek to transform healthcare with breakthrough innovations in medical technology. Launched in 2019, Vensana is actively investing in development and commercial stage companies across the medtech sector, including medical devices, diagnostics and data science, life science tools, digital health, and tech-enabled services. Vensana’s investment team has a history of successfully partnering with management teams behind industry-leading companies including Cameron Health, CardiAQ, Cartiva, CV Ingenuity, CVRx, Epix Therapeutics, Inari Medical, Intact Vascular, Lutonix, Neuwave Medical, Respicardia, Sequent Medical, Topera, Ulthera, Veran Medical Technologies, and Vertiflex. Learn more at www.vensanacap.com.

Contact:

Steve Schwen, Chief Financial Officer

(612) 217-8688

Vensana’s Kirk Nielsen to Co-Chair the 2021 Medtech Venture & Partnering Conference in Minneapolis

CVRx, Inc. Announces Upsized Pricing of Initial Public Offering

This AI Startup Raised $43 Million To Save Lives (And Money) By Treating Heart Disease Earlier

Cleerly Launches with $43 Million Series B to Provide a New Standard of Care for the Leading Cause of Death – Heart Disease

GPB Scientific Announces Additional Growth Financing to Support Commercialization of Curate™ Cell Processing System for Next-Generation Cell & Gene Therapies

Vensana Capital Founders Offer Public Comments in Support of CMS Final Rule, “Medicare Program; Medicare Coverage of Innovative Technology (MCIT)”

Vensana Capital, a medical technology-focused venture capital firm based in Minneapolis and Washington, DC, is submitting this letter in response to the interim final rule delaying the effective date and requesting additional comment on the final rule establishing the MCIT coverage pathway for Food and Drug Administration (FDA)- designated breakthrough medical devices (“Notice of Delay”).1

We urge CMS to move forward with implementation of the MCIT coverage pathway regulation starting on the delayed effective date of May 15, 2021.

Click on link below for full comment letter:

NVCA VC Policy Pulse: Medical Device Coverage Reform with Vensana’s Justin Klein & Kirk Nielsen

VC Policy Pulse: Medical Device Coverage Reform with Vensana’s Justin Klein & Kirk Nielsen

Welcome to our VC Policy Pulse series, where we speak with VC investors on policy issues that are having a major impact on the VC and startup ecosystem. Today, we’re hearing from Justin Klein and Kirk Nielsen, co-founders & Managing Partners of Vensana Capital, about the effects of federal policy on medical device innovation in the U.S. and how reformed coverage policy for innovative technologies from the Centers for Medicare & Medicaid Services (CMS) could help advance new medical devices and accelerate access to these products for Americans.

Background

For quick background on the issue, CMS issued the final rule regarding the Medicare Coverage of Innovative Technology (MCIT), which NVCA supported in a comment submission in November 2020. Originally intended to go into effect March 15, but now on hold pending a second comment and review period, the rule would establish a new MCIT pathway to provide four years of national Medicare coverage as early as the same day as market authorization for FDA-designated breakthrough devices. See the fact sheet and press release from CMS for details.

NVCA has long advocated for reforms to the coverage and reimbursement processes at CMS that are critical to encouraging investors to take the long-term risk of pursuing new medical device innovations that will save and improve patients’ lives and spur U.S. job creation. The MCIT rule has the potential to accelerate patient access to much needed medical technology innovation and would bolster investment by medical device investors who have supported improvements to this complex process of bringing innovative medical products to market.

Q&A with Justin Klein & Kirk Nielsen

Justin Klein

Kirk Nielsen

What is MCIT and why is it seen as such an important development in the medical technology sector?

At its core, MCIT is all about improving patient access to innovations that can change their lives and save our healthcare system money. MCIT would create a new process by which innovative medical devices and diagnostics, that are addressing significant unmet needs and are designated by FDA as breakthrough technologies, can receive four years of immediate Medicare coverage once they receive FDA approval or clearance for marketing. Unlike novel drugs, which are typically covered as soon as they are approved, obtaining coverage for innovative medical technologies is a process that can take many years and is fraught with challenges. Providing an expedited pathway to coverage not only allows Medicare beneficiaries to immediately benefit from important new medical products, but also encourages more venture capital investment in the companies developing these products – setting up a virtuous cycle to support innovation.

The fact that a rule intended to already be in effect is instead undergoing a second public comment period is frustrating for many entrepreneurs, investors, and the physicians and patients we aim to serve. But the original rule garnered significant support from many stakeholders and was broadly politically bipartisan, so we’re happy to renew our effort to educate people who sought this review.

How might the MCIT pathway from CMS impact VC investors and medical device startups? How will this change to CMS’s coverage and reimbursement processes encourage investment in medical device companies?

Both FDA and CMS have prioritized innovation in medical technology as an important part of improving clinical outcomes for patients at reduced costs to the healthcare system. But demonstrating that a novel medical technology is both “safe and effective” for an intended use (to satisfy FDA’s requirements for approval) and “reasonable and necessary” to be covered by CMS often requires substantial clinical evidence generation. This creates a challenge for companies in the sector, as the clinical trials required to support these dual objectives are often beyond the scope of most investors – in terms of both cost and time horizon. MCIT would streamline the process and allow companies to develop additional clinical evidence over a period of time.

For many years, investors have shied away from truly breakthrough products that would require new reimbursement codes and coverage and have instead largely focused on cheaper-better-faster products in existing categories. However, as a society, we need those breakthrough products that have the potential to dramatically improve our healthcare system, like percutaneous heart valves that turn an open-heart surgery into a minimally invasive procedure, platforms that can diagnose multiple cancer types through a single blood-draw, or therapies that change the way that major chronic diseases are treated. MCIT would be a major step toward making those transformative projects more readily fundable again, particularly at the seed and early stages. In fact, we – like other investors – have already been proactively considering breakthrough products and MCIT as part of our assessment of new opportunities, and we recently made commitments to three companies that have received FDA breakthrough designation (Alleviant Medical, CVRx, Personal Genome Diagnostics).

It is important to point out that MCIT would not change the burden of proof required by any new product. Ultimately, these innovations will still need to demonstrate convincingly that they are reasonable and necessary for Medicare beneficiaries to maintain longer term CMS coverage, and our entrepreneurs know that they must bring the goods when those four years expire. But the MCIT program could provide an earlier window in which they can start to generate revenue, build their businesses, and potentially exit, while they invest in parallel to deliver robust clinical evidence to support permanent coverage.

Who have been some of the key advocates that helped on this issue and pushed to make this reform happen?

This has truly been a team effort with engagement and support from medical technology entrepreneurs, large medical device companies, VC investors, and certainly key advocates for innovation including AdvaMed, the Medical Device Manufacturers Association (MDMA), and NVCA. Significant credit is also due to leaders within CMS, HHS, and the administration for recognizing that medical technology entrepreneurship – especially early-stage innovation – has long struggled against the headwinds created by the serial process for getting products approved by FDA and then covered by insurers, including Medicare. They were proactive in engaging with us, sought to really understand the challenges we face, and worked collaboratively to design a program that could durably tip the scales in favor of accelerating investment in medical technology innovation for years to come.

What advice would you give to VCs or entrepreneurs that are interested in engaging on policy issues that impact the startup ecosystem?

By all means, engage. The best way to improve the policies that impact our ecosystem is to make your voice heard, and to bring your experience and on-the-ground perspectives to bear to help make positive change. Focusing your efforts through the relationships and channels that groups like NVCA have spent years developing is one of the most effective ways to have an impact, whether it’s in healthcare, tax policy, intellectual property, improving diversity in our industry – the list goes on and on. Find the issue that you’re passionate about and engage.

Justin Klein, MD, JD, and Kirk Nielsen are co-founders and Managing Partners of Vensana Capital. Kirk is also a member of the NVCA Board of Directors. Vensana is a venture capital and growth equity investment firm dedicated to partnering with entrepreneurs who seek to transform healthcare with breakthrough innovations in medical technology. Launched in 2019, Vensana invests in development and commercial stage companies across the medtech sector, including medical devices, diagnostics, drug delivery, digital health, tech-enabled services, and life science tools. www.vensanacap.com

NVCA Policy Pulse: Medical Device Coverage Reform with Vensana’s Justin Klein & Kirk Nielsen

Personal Genome Diagnostics Announces Close of $103 Million Series C Financing

Webinar: How Medtech Can Sustain Its Momentum in 2021: Strategies for Successful Investment, Co-Moderated by Justin Klein

SpyGlass Ophthalmics Completes $27.5 Million Series B Financing to Advance Novel Treatments for Chronic Ophthalmic Diseases

Relievant Medsystems Announces $70M Financing to Accelerate U.S. Commercialization of Intracept Procedure

Philips to expand its image-guided therapy devices portfolio through acquisition of Intact Vascular

CVRx® Raises $50 Million in New Equity Financing

Klein to speak at Life Sciences Future – MedTech

Eight VCs Join NVCA Board and Barry Eggers of Lightspeed Appointed Chair

GPB Scientific Announces $25.5 Million Financing from Vensana Capital and Amgen Ventures

Vensana—Is Medtech Investing on the Rebound?

New med-tech investment firm Vensana Capital launches $225 million fund

Minneapolis-based Vensana Unveils $225 Million Venture Capital Fund

Co-founded by Versant, NEA investors, new medtech VC firm kicks off inaugural fund with $225M bounty

New Medtech Investor Vensana Closes $225 Million Debut Fund

Vensana Capital Launches with Inaugural $225 Million Fund

Podcast: Medtech VCs Klein, Nielsen Explain Why They Decided to Start Up Their Own Venture Firm, Vensana

Kirk Nielsen featured at MedTech Strategist Medical Alley Innovation Summit 2019

Vensana Capital Co-Organizes 26th Annual Phoenix Conference

TEDCO to Host Entrepreneur Expo on October 29 – Vensana Capital’s Justin Klein and AllegisCyber’s Bob Ackerman morning keynotes at the Expo

TEDCO’s annual Entrepreneur Expo was established to spotlight entrepreneurship in the region by bringing together Maryland’s various resources for a day of celebration.